Best Investment Strategies for Middle-Class Families: Diversify and Secure Your Financial Future

When considering the best investment for a middle-class family, it’s crucial to balance security, potential returns, and long-term financial goals. Each investment option offers unique advantages and challenges that must align with a family’s financial situation and risk tolerance.

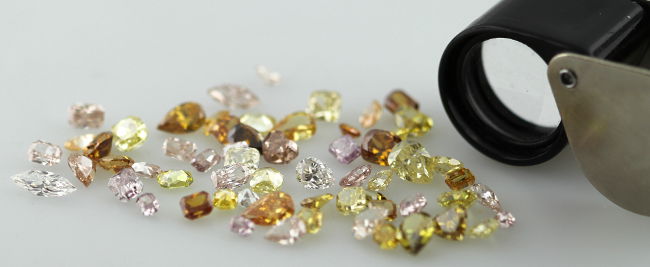

Gold and Silver are tangible assets that have historically provided a hedge against inflation and market volatility. While they may not generate substantial returns, these precious metals can diversify a portfolio and offer a sense of security. However, families must consider the challenges of physical storage and potential price fluctuations. For those seeking exposure without the hassles of physical ownership, ETFs (Exchange-Traded Funds) provide a viable alternative.

Cryptocurrencies present the allure of high potential returns, making them intriguing yet risky investments. Their volatility, regulatory uncertainty, and security concerns mean they may not be suitable for most risk-averse middle-class investors. However, for those willing to accept the risks, crypto can be a speculative investment with the potential for substantial gains. Thorough research and starting with a small investment amount are essential.

ETFs are another accessible and diversified approach to investing, particularly suitable for middle-class families. They offer lower costs, tax efficiency, and professional management. While ETFs may not generate the same explosive returns as some individual stocks, they provide a more stable and predictable investment option ideal for long-term wealth building.

Homeownership is often seen as a cornerstone of middle-class wealth building. It provides stability, potential appreciation, and tax advantages. However, it comes with significant upfront costs, ongoing expenses, and limited liquidity. Homeownership is a long-term commitment, requiring careful consideration of financial circumstances and lifestyle preferences.

Lastly, Cash is the foundation of any sound financial plan. It offers security, liquidity, and peace of mind, serving as a crucial resource for emergencies, unexpected expenses, and future investment opportunities. Building a substantial cash reserve is essential before exploring other investments, ensuring a stable financial base for a middle-class family.

In conclusion, the best investment for a middle-class family depends on balancing security, potential returns, and personal financial goals. Diversifying investments across different assets like precious metals, ETFs, real estate, and maintaining a solid cash reserve can provide a well-rounded approach to long-term financial stability and growth.

Donna is your friend in the know. Her blog is a treasure trove of insightful tidbits on a wide range of topics. From wellness to technology, she’s your source for staying informed and inspired.